From event-marketing guides to creator interviews, these are our experts’ current favorites.

The 2025 Music Fans Report is Here

Music fans’ passion for live music is unwavering. That’s why they’re the headline act in our annual music report. We spoke to industry experts and dived into Eventbrite data to discover what fans want in 2025.

Stand Out, Sell Out, and Reach More Music Fans With Eventbrite’s Latest Tools

With Eventbrite’s latest tools, we’re helping indie music venues and promoters turn event discovery into sold-out shows.

My Event Full Life: Radha Agrawal of Daybreaker

Daybreaker founder Radha Agrawal shares how her vision to reinvent the traditional dance party has created transformative experiences for an intergenerational community, and reveals what happened when her events caught the attention of Oprah Winfrey.

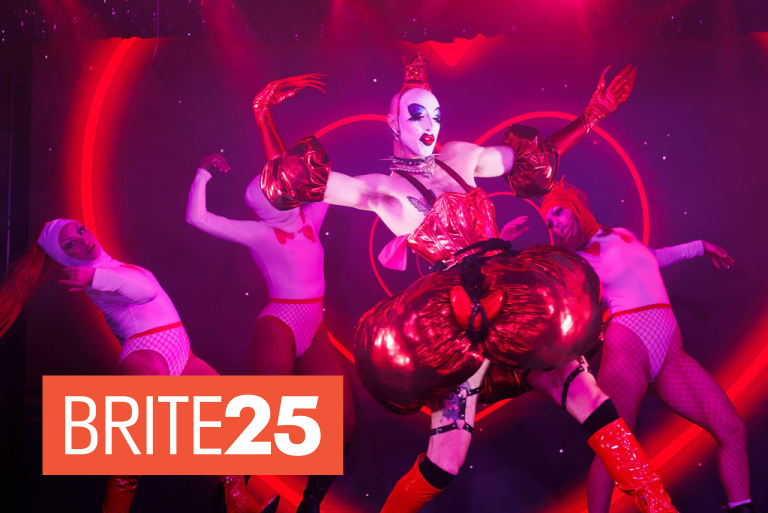

How Poof Doof Remains a Scene-Leader and Continues To Grow With Eventbrite

Having grown to include regular events in Sydney, Brisbane, Perth, and internationally, since switching from a competitor to Eventbrite in 2024, Poof Doof is sharing the fun more than ever.

TRENDING

TIPS & GUIDES

Discover actionable insights and ideas to help you plan, market, and manage your events.

Hot take, folks, but venue marketing? Waaaaay more complex than promoting a one-off event—and here’s why. With standalone events, your mission is clear: sell tickets, build hype, get people…

I recently attended a small indie music festival where everything seemingly went well. The sets flowed smoothly, with no awkward pauses. The sound system was crisp and well-balanced. Even t…

Every event organizer who wants to scale eventually has to come to terms with the fact that event staff training is not optional. You can't be in two places at once or control everything, so you nee…

NEWS & TRENDS

Stay up-to-date on the latest in live events with our exclusive insights, trends, surveys, and reports.

See allCommunity

Learn about the vibrant community that powers Eventbrite, and explore programs and events to skillshare, support, and connect with other creators.

Reconvene events & recaps

Creator Spotlight

‘Power In Numbers’: In Todo Craft Fair’s Vendor Community Is Its Secret Marketing Weapon

Read moreTOOLS & FEATURES

Tips, tricks, and customer success stories for getting the most out of Eventbrite’s tools and features.

Pro Marketing Results Without Pro Hassle

The all-in-one event marketing platform to sell more tickets and grow your business.

Learn moreGet started with Eventbrite IN MINUTES

Everything you need to sell tickets to virtual and in-person events — all in one place.

Get started free