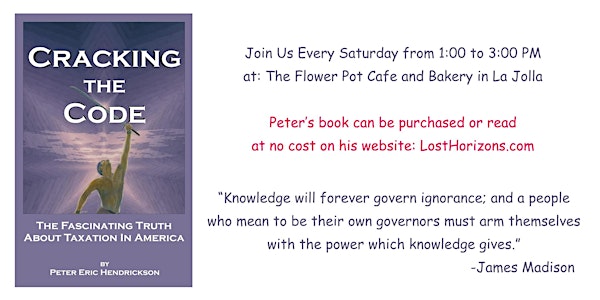

Cracking The Code: The Fascinating Truth About Taxation In America

A Book Study and Discussion Group

Location

The Flower Pot Cafe and Bakery

7530 Fay Avenue San Diego, CA 92037About this event

The Independent Thinker’s

INCOME TAX FACT SHEET

Each year, millions of Americans report their earnings to the IRS, allowing a significant portion of their wealth to be claimed by the government. Yet the law itself stipulates that tax is only to be paid on a certain kind of income – a truth about which most Americans remain blissfully unaware.

Here are 10 facts you should know:

1) The income tax is an excise tax, not a direct tax. It applies only to revenue in which the federal government has a direct ownership interest.

2) What is called “income” by the Internal Revenue Code is not “money” or “receipts” or “earnings.” It is defined as receipts resulting from the exercise of federal privilege. Are you doing business with or are you paid by the federal government?

3) The income tax was instituted in 1862. The 16th Amendment (1913) did not expand the scope or definition of taxable “income.” Until the 1940’s, only about 4% of Americans (those who worked for or were involved with the federal government) paid annual income tax.

4) During WWII, the government called for Americans to pay income tax as support for the war effort. Patriotically, a large number of citizens complied.

5) The Internal Revenue Code grew to more than 3 million words. A wage-withholding program was instituted and thousands of professionals now help Americans prepare their tax returns.

6) Each year, millions of W-2 and 1099 reports are issued for “wages” or “non-employee compensation” by payers who do not understand that these forms are intended for federal entities making federally connected payments. W-2 and 1099 forms serve as legal testimony and, without rebuttal, make the named individuals liable for an “income” tax.

7) The “Form 1040 U.S. Individual Income Tax Return” is intended as a way for individuals to correct information “testimony” made about them by others. Americans have until April 15th of each year to correct their record. Not filing a tax return waives your right to properly report your “income.”

8) While Congress cannot take your money directly, it has created a tax code that is convoluted enough to deceive most people. “Income”, “wages,” “employee”, “employer” and “trade or business” are all specifically defined in the Code, yet most of us interpret these words in a common or everyday way.

9) Once a return (1040 Form) is filed, it is legally valid and answers the question of whether or not you were engaged in taxable activities for that year. It is the means – provided by law – for YOU to set the record straight.

10) The U.S. tax system is based on individual self-assessment and voluntary compliance. The government will accept your money unless you inform it every year that you are entitled to non-payment or to a refund of what you have paid.

Most Americans are woefully uninformed about the nature of who is to pay income tax. Reporting “income” and deducting “expenses” is the only relief available to many, even with the help of trained professionals, all of whom operate under the same misconceptions.

Common misunderstandings:

· There is no law that says I have to pay income tax

· The 16th Amendment was never ratified

· Filing a tax return makes me part of “the system”

· It’s better to pay my taxes and stay out of trouble

FACT…Only a certain kind of “income” is taxable

The U.S. Constitution denies the government the right to tax a person’s exercise of the fundamental individual right to work or trade. Although many people believe the “income” tax is unconstitutional, they do not understand how the imposition of this tax has become legal. The good news is that the internal Revenue Code provides you a way to declare your freedom from income tax each and every year.

Cracking The Code:

The Fascinating Truth About Taxation in America

by Pete Hendrickson

Join thousands of Americans who have unchained themselves

from a pervasive system that feeds on their ignorance.

“Cracking the Code” is a book that explains this simple and lawful process.

It has enabled those who have read it to demand their money back from the IRS.

Wouldn’t you like to be one of these people?

Lost Horizons.com

Frequently asked questions

There is plenty of free on-site and on-street parking available nearby.

There is both indoor and outdoor seating. Seating will be determined by what's available upon arrival. There is plenty of shade outdoors. Dress in layers for comfort.

Yes. There is wi-fi available and there are several outlets inside.

No. We'll be reading and discussing parts of the book at every meetup. However, it will benefit both you and the group to familiarize yourself with this information.